A Miracle Product for Your Finances

Houzz of Fabulass would not be fabulous without a discussion about your finances. I found a great product that can help you get your finances in check!

Let's face it, today's economy is riddled with insecurity. The economy is still unstable and virtually unpredictable. Credit card use is on the rise and most incomes have not shown a substantial increase in a good while. I believe it is a worthwhile to face your finances head on and find a plan to get them in shape. Too often people have put aside their credit card debt and felt the minimum payments are enough. Most never focus on a savings or a retirement plan which is essential for a healthy financial future. Many people will throw themselves at the mercy of their banks for help and never get it. It is just awful when you find that all of the hard work to pay your debts have not been fruitful at all. All of the interest is compounding. You haven't established a savings or a retirement plan because there is never any money left. Maybe you have lost out in thousands of dollars in investments because you were unable to track your money effectively.

It does not have to be this way. What if I told you that you can have all of your financial planning at your fingertips? I found a product called VeriPlan Financial Planning Software from www.myfinancialfreedomplan.com. This software gives you a sense of empowerment because it helps you save money and you control your own destiny! What a great way to help you pay off your debt! Imagine having this tool at your fingertips to help you estimate how much you need to set aside for your savings, retirement, your child's college education fund, or a vacation trip. Imagine how great it would be to have a plan in place to help you gain a tighter grip on your credit card debt. Imagine being able to set up scenarios to help you pay your taxes, track your investments, plan your budget, calculate your Roth IRA, plan your savings, or even plan for your real estate savings.

The software has sophisticated, automated, and lifetime modeling tools that are fully customized to your needs. Fully personalized lifetime planning scenarios are provided to help you make informed decisions.

Guys, this amazing! I have seen other software programs out there like QuickenBooks but it is skimpy in comparison to the Veriplan Financial Software Program on www.myfinancialfreedomplan.com for $49.95. I have posted some of the highlights of the software program but you have to go check out this program on their site for yourself to do it justice! There are just too many details to list.

VeriPlan

Simply the Best

Lifetime and Retirement

Financial Planning Software

New version with 15-minute planner now shipping

Download immediately for any Mac or Windows PC with Microsoft Excel

Easy-to-use do-it-yourself home financial planning software

- Plan your lifetime financial freedom and retirement security

- Save money and control your own financial destiny

- Integrate all your objectives into a comprehensive and unified lifetime plan

- Model your particular income, expense, debt, tax, and investment situation

- Focus on decisions, while complex computations run automatically in the background

- Gain clarity through standard projection graphics and data tables

- Follow clear instructions provided in the software right where you need them

- Easily update your plan in the future to track progress and evaluate new decisions

VeriPlan puts you in the financial planning driver's seat

Sophisticated, automated, and customized lifetime modeling tools

- Automatically analyze your lifetime income, expenses, debts, asset returns, taxes, and investment cash flows

- Make long-term decisions based on fully personalized lifetime planning scenarios

- Develop lifetime projections for your particular tax situation

- including US federal, state, and local graduated income taxes; tax deductions; property taxes; short-term and long-term investment capital gains taxes with asset tax basis tracking; Social Security taxes; Medicare taxes

- change any tax setting

- Instantly revise your plan, whenever you change any assumption or input

Standard lifetime financial planning and retirement graphics

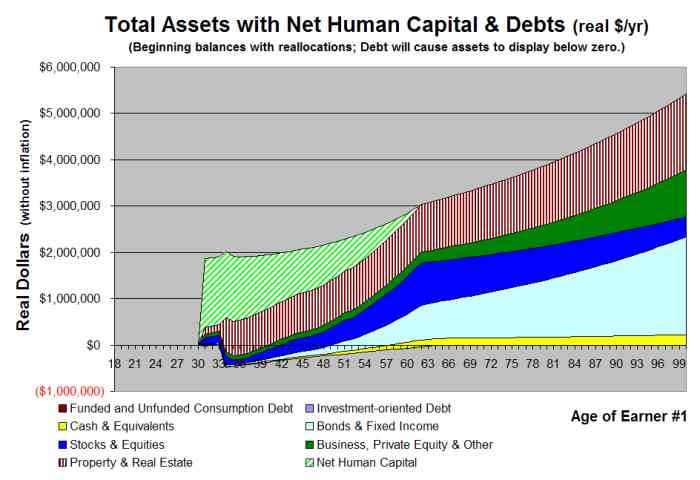

An example of VeriPlan's automatically generated graphicsFully personalized financial projection scenarios

Compare unlimited lifetime financial planning scenarios with VeriPlan's cash flow modeling and retirement planning software

- Change any and all earnings, expense, debt, tax, investment, or savings assumptions

- Adjust for major planned expenses in each and every year

- Automatically estimate the present value of your lifetime savings and human capital

- Model a wide variety of retirement investment, retirement income, and retirement withdrawal planning strategies

- Optimize your taxable, traditional tax-deferred, and Roth account investment strategies

- Model lifetime investment risk and returns with automatic asset allocation and rebalancing tools

- Vary expected asset class returns systematically to test returns projections

- Project portfolio safety margins provided by your cash and bond assets

- Model the cumulative, lifetime impact of excessive investment costs and fees

VeriPlan's personal financial planning software power tools

VeriPlan includes these fully integrated financial planning tools

- Lifetime earnings, expense, and retirement savings calculators

- Income, property, and capital gains tax calculators

- Home purchase and mortgage calculator tools

- Retirement planning calculator and income calculator tools

- Tax-advantaged retirement planning tools

- Debt management calculators

- Asset allocation calculator and rebalancing tools

- Investment cost reduction tools

- Investment returns calculators

- Investment portfolio risk tools

- Investment portfolio safety tools

Fully integrated earnings, expense budgeting, and retirement savings:

Veriplan's lifetime earnings, expense budgeting, and retirement savings calculators

- Project salary, bonus, and self-employment income until your retirement at any age

- Incorporate any other expected income sources before and after retirement

- Make any positive or negative annual income adjustments on a year-by-year basis

- Fine tune your earnings growth rates for each income source

- Easily adjust projected expense inflation rates

- Add major planned expenses in any year, such as home renovations, new babies, elderly parent care, vacations, etc

- Enter positive and negative annual expense adjustments and with different inflation rates in any projection year

- Use as a children's educational expense and college planning tool with adjustments for expected scholarships and loans

- Use as a career education expense planning tool to model the trade-offs associated with returning to school for career advancement

Do all this automatically, while VeriPlan simultaneously projects all of your debt payments, taxes, investment appreciation, and investment expenses!

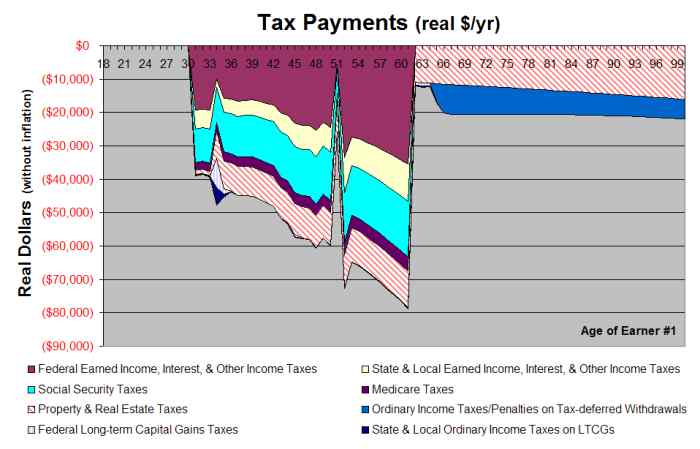

Completely integrated and fully automated lifetime tax projection software

Income tax calculators, property tax calculators, and capital gains tax calculator tools

- Fully integrated tax planning software calculators automatically project your lifetime tax obligations in eight different tax categories

- Uses the particular federal income tax, state income tax, and local income tax rates and limitations that currently apply to you

- Projects your personal tax exemptions, adjustments, and deductions plus your property and your short-term and long-term capital gains taxes

- Change all tax rates and limits supplied with VeriPlan, if tax rates change in the future

A VeriPlan lifetime tax planning worksheet graphic

Easily change any and all of VeriPlan's tax settings

Through age 100, VeriPlan automatically generates

personalized tax projections using ...

- ... your current graduated U.S. federal income tax rates and limits (that you can change).

- ... your current variable or flat state income tax rates and limits. (VeriPlan comes with state income tax rates for the 50 United States and Washington, D.C. Select any state to develop your projections.)

- ... local personal income tax rates and any limits. (VeriPlan can project: no local taxes, flat local tax rates, graduated local tax rates, or the New York City income tax rates that are provided.)

- ... different levels of taxable income at the federal, state, and local tax levels, if you wish.

- ... the 'Single' or "Married, Filing Jointly' federal income tax filing status. VeriPlan automatically applies the tax rates and tax limits that are associated with either of these filing statuses.

- ... up to 10 tax exemptions for your tax dependents, including age related phase-outs.

- ... up to 6 adjustments to your income subject to income taxes.

- ... your federal income tax deductions, (while automatically applying the more favorable of either the standard tax deduction or your itemized tax deductions in any projection year.)

- ... your applicable Social Security (FICA) and Medicare taxes.

- ... either salaried employee tax rates or self-employment tax rates, as appropriate.

- ... your long-term qualified dividend and long-term capital gains taxes on your long-term capital gains distributions and asset withdrawals.

- ... your cumulative asset class tax basis for assets and asset classes. (VeriPlan projects taxes net of your cumulative asset tax basis.)

- ... your total property taxes, real estate taxes, and other assessed property taxes.

To make better financial planning decisions, you need after-tax

projections that reflect your particular tax situation!

For up to 5 Homes, 10 Rentals, and 10 Other Properties

VeriPlan's property and real estate calculator tools automatically:

- Project key asset, expense, tax, and cash flow factors associated with owning now and/or purchasing/selling in the future up to 5 homes, 10 rentals, and 10 other properties

- Calculate the cash you need to complete these transactions, including down payments, buying/selling/closing costs, and other settlement cash requirements net of any planned mortgages/debts, while taking into account interim asset appreciation and taxation

- Add new homes, rentals, and other property assets to your portfolio in the future and project future real estate price appreciation, maintenance costs, other expenses, and property and business taxes

- Project the cash flow value to you of future mortgage interest, business, and real estate tax payments as income tax deductions, while taking into account exclusions and income limitations

- Track positive and negative after-tax cash flows related to homes, rentals, and other businesses related to ongoing operations, purchases, and sales

- Manage future expenses to prepare and sell each property, while taking into account projected values, tax basis, depreciation, and capital gains on real estate and other property sales

- Handle current and future debts associated with homes, rentals, and properties including cash flow, deductions, limitations, and accelerated retirement of any debt

VeriPlan's rich set of retirement planning tools with VeriPlan's Social Security retirement estimator, retirement annuity calculator, and retirement pension calculator tools, you can easily:

- Set individual retirement ages and select whether a married working couple would retire simultaneously or in different years

- Adjust your planned retirement living expenses and the expected inflation rate of your retirement living expenses

- Adjust your retirement expenses year by year (For example, you could add the projected cost of an ocean cruise every two years during your retirement.)

- Set your current Social Security retirement income payment entitlement levels and evaluate your decision about which age to accept your first Social Security payments (If you wish, VeriPlan's Social Security retirement calculator tools allow you can scale back the amount of your projected Social Security retirement payments, by a percentage reflecting any concern over the adequacy of Social Security trust funds.)

- Because older workers can face erosion of real dollar wages, adjust your assumptions about your real dollar wages, if you plan to keep working

- Project up to 10 separate pensions and annuities (For each of your pensions or annuities, the VeriPlan retirement calculator with pension tools will automatically project: a) the dollar amount of the monthly annuity or pension payment, b) separate real dollar growth rates before and after the first pension or annuity payment, c) whether annuity or pension payments would begin at a specific age or at retirement, d) the duration of pension or annuity payments, and e) the taxability of annuity or pension payments.)

- Understand better your preparedness for a long life and long retirement, since every VeriPlan projection automatically analyzes the adequacy of your financial resources through age 100

A VeriPlan retirement income graphic

No comments:

Post a Comment